Analysis of Ulta Beauty

This is my first in-depth analysis of a company. I consider myself a quality investor and would love any feedback about my analysis.

Jack Pieja

5/21/2024

Ulta Beauty Analysis

Business

Ulta Beauty is the largest specialty beauty retailer in the United States and the premier beauty destination for cosmetics, fragrances, skin care products, hair care products, and salon services. They offer over 25,000 different products from 600 different beauty brands. These products range in price depending on their prestige or mass-market status. Ulta currently operates more than 1,350 stores, all located in the United States, along with their online store. They also have a partnership with Target, where they operate shop-in-shop locations, which are smaller versions of regular Ulta Beauty stores.

Regarding their website, Ulta strives to provide guests with a personalized experience tailored to their preferences. The website features virtual try-on tools and skin analysis using artificial intelligence to enhance the online shopping experience. Orders from the online store can be shipped to local stores, shipped to homes, or delivered on the same day. Data suggests that customers tend to spend up to three times more online than in physical store, so maintaining a high-quality online presence is crucial.

Ulta's customer base is predominantly female, but there has been a small increase in male shoppers as well. Their customer loyalty is strong, with 95% of total sales coming from their loyalty members. These members earn points for purchases, which can be redeemed for discounts on other products. This loyalty program allows Ulta to gain deeper insights into their customer base and to better predict beauty trends and product demands.

Ulta’s growth plan, initiated in 2021, focuses on providing products that meet customers' needs, including black-owned products and environmentally friendly options. They also recognize that customers prefer shopping in physical stores and plan to continue opening new stores in high-traffic areas. Management estimates that they will cap the number of stores between 1,500 and 1,700 in the United States. Ulta Beauty currently has 500 shop-in-shop locations with Target and believes there is room to expand this number to 700-800.

Ulta offers six primary categories that contribute to revenues: cosmetics, skincare, hair care and styling tools, fragrance and bath, and services. The largest portion of total revenue comes from cosmetics, which accounts for 41% of total revenue. Skincare and hair care each account for 19% of total revenue. Maintaining good relationships with suppliers is crucial, as ten brand partners make up 56% of total net sales. Supplier relations have been strong over the years because both Ulta and their suppliers rely on each other to sell products. For instance, if L’Oréal were to stop supplying to Ulta, both companies' revenues would drop, although Ulta's would suffer more. This mutual dependency strengthens the long-term partnering of these suppliers.

The specialty beauty retail business is very resilient, as beauty products are among the last items consumers cut during a recession. This resilience was evident during the COVID-19 pandemic when sales initially dropped 17% but then rebounded by 40% in 2022. Ulta Beauty holds the largest market share in the industry at 9%, while their closest competitor, Sephora, holds only 4.3%.

Financials

When assessing the company’s financial position, it is important to examine its gross margin, operating margin, return on capital employed, debt levels, cash flows, and its ability to convert income to cash. Other important factors include revenue growth, growth in the bottom line, growth in operating cash flow, and free cash flow.

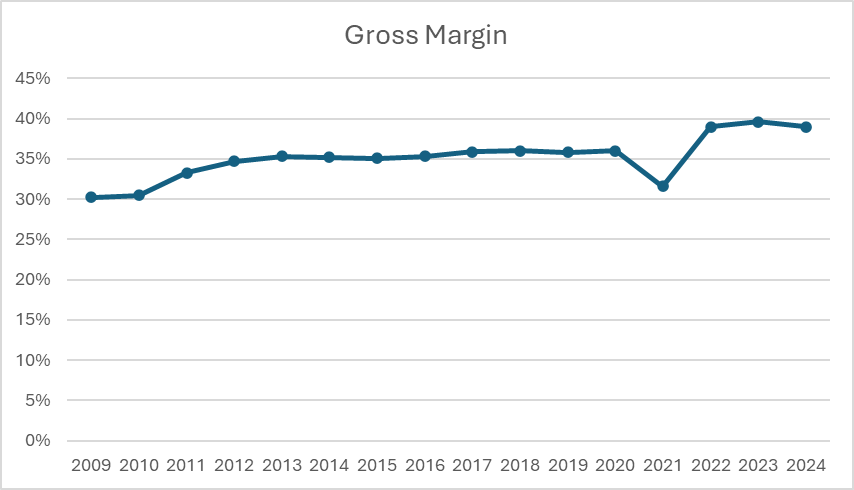

Analyzing the long-term performance of the gross margin and operating margin, both have increased over the years, with the averages over the past five years being 37% and 12%, respectively. These figures are somewhat low due to the impact of COVID-19, which reduced both margins. However, when looking at the most recent margins, they are in the high 30% and low 40% range for the gross margin and the mid-teens for the operating margin. The graph illustrates the gross margin of the company over the period from 2009 to 2024. Gross margin is calculated by dividing gross profit by total revenues.

The graph illustrates the gross margin of the company over the period from 2009 to 2024. Gross margin is calculated by dividing gross profit by total revenues.

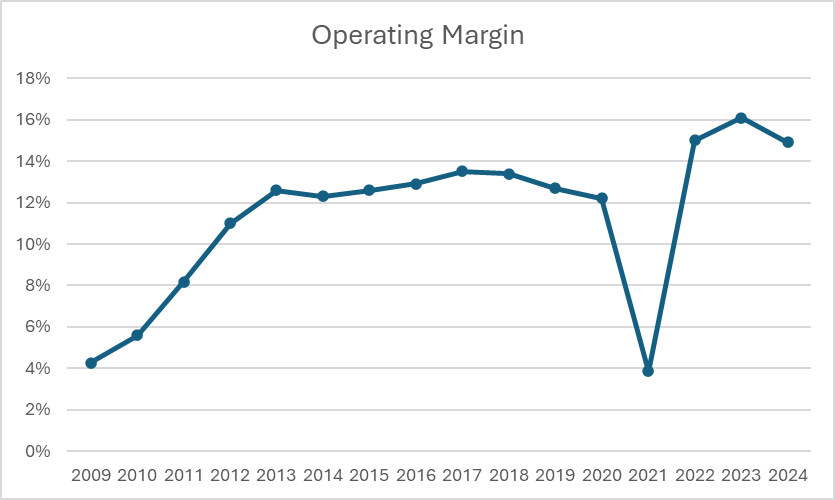

The graph illustrates the operating margin of the company over the period from 2009 to 2024. Gross margin is calculated by dividing operating profit by total revenues.

The graph illustrates the operating margin of the company over the period from 2009 to 2024. Gross margin is calculated by dividing operating profit by total revenues.

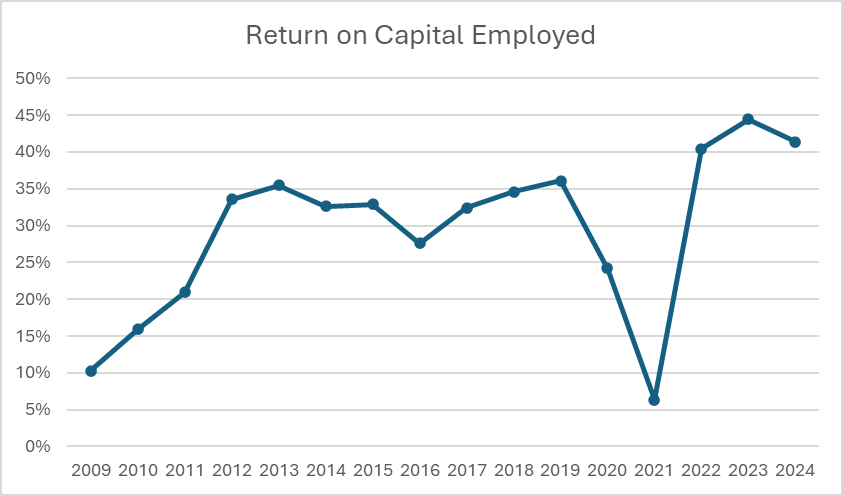

When looking at the specialty retail industry, the average gross and operating margins are 35% and 7%, respectively. Therefore, Ulta Beauty is much better at converting revenue to the bottom line than other companies in the same industry. One of the most important metrics is the return a company receives from the capital that is employed in the business. As shown in the figure below, Ulta has been able to increase its ROCE (Return on Capital Employed) over the long term, and it currently has a value of 41%.

The graph illustrates the Return on Capital Employed of the company over the period from 2009 to 2024. ROCE is calculated by dividing operating profit by total assets minus current liabilities.

The graph illustrates the Return on Capital Employed of the company over the period from 2009 to 2024. ROCE is calculated by dividing operating profit by total assets minus current liabilities.

When looking at the industry average of 13% ROCE, it is evident that Ulta Beauty’s management deploys cash more effectively than their peers. There should be no reason why this level of ROCE cannot be sustained over the long term. However, this metric is less meaningful if the company cannot grow, which will be discussed later.

In terms of debt levels, the amount they carry isn't a concern, given their current debt-to-equity ratio of 1.5. Their interest coverage ratio is negative, it's worth noting that this stems from their net positive interest expense. The Debt-to-Equity Ratio, calculated by dividing total liabilities by stockholders’ equity, encompasses all financial obligations. However, it's important to highlight that the company doesn't have any debt in this regard.

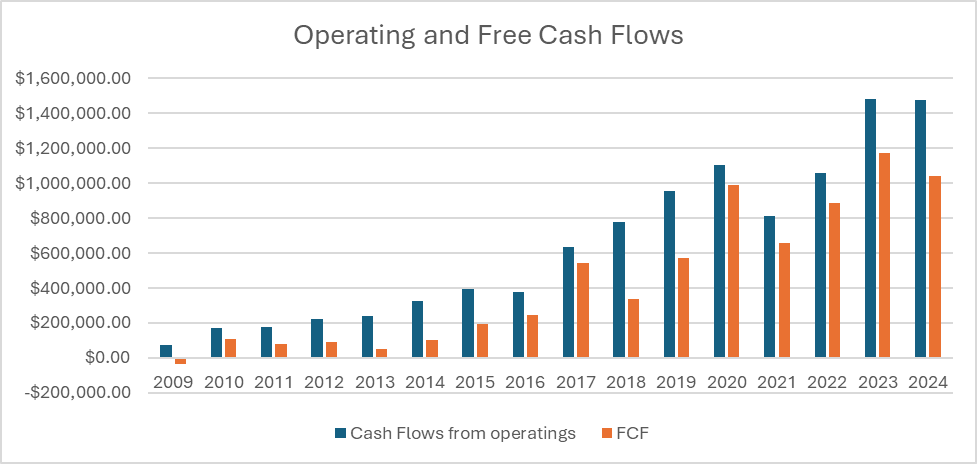

The importance for a company to make predictable cash flows is important as it allows them to meet financial obligations, make strategic investments, return cash to shareholders, and seize opportunities for growth. When looking at Ulta’s operating and free cash flows we can see that overtime they have grown consistently over time and have been fairly predictable; except for the past five years which was due to the impact of COVID and the effects that people are feeling from inflation and interest rates.

Note: These figures are in thousands of dollars.

Note: These figures are in thousands of dollars.

The ability of a company to convert its income into cash is extremely important, especially when it has a high return on capital. The faster a company can collect cash, the faster it can deploy that cash at high rates of return. Examining the cash conversion ratio, we can see that the company has converted more than 100% of its income into cash for the past couple of years, indicating there is almost no delay in receiving cash from customers.

Growth

The growth in revenue over the past five years has averaged around 12% per year. This has been driven by an increase in the number of net stores opened, an increase in same-store sales, and an increase in the use of their online website. With management's expectation of 1,500 to 1,700 total stores in America, we can see that even on the low end, there is still room for growth in the physical store segment. Additionally, there is growth in the partnership with Target, where another 300 possible stores could be opened. The percentage of new store openings will decrease, but for the next couple of years, we can expect a 2-3% growth in new store openings and around a 3-5% increase in same-store sales. The average same-store sales growth since 2009 has been 8.61%, and in management’s Q4 2023 Earnings call they are expecting same store-sales to increase into the future at 4-5%.

The US is not the only country where Ulta plans to do business. In the Q4 2023 earnings call, David Kambell announced, the company will expand into Mexico in 2025 through a joint venture with Grupo Axo. Axo is a global brand operator with experience exporting brands to Latin American countries, including Mexico, Chile, Peru, and Uruguay. While the news of expansion into foreign countries is promising, there is no guarantee of success. Sephora, one of their largest competitors, opened their first store in Mexico in 2011 and plans to continue their expansion. Therefore, there will be competition from them as well as local beauty retailers.

Regarding growth in the industry at large, analysts expect that the industry will grow annually between 6%-10% until 2030. So, when considering the expansion of stores in the US, Mexico, and Target shop-in-shops, the increase in same-store sales of around 3%-5%, and the overall industry growth, Ulta Beauty should be able to continue growing at a solid pace, thereby continuing to effectively employ their cash and receive a high return on capital.

Management

When looking at the management, we see that there has been some turnover in recent years. David Campbell was named CEO in 2021 but has been with the company since 2014. Kecia Steelman has been the President and Chief Operating Officer since 2021 but has also been with the company since 2014. Scott M. Settersten was the CFO up until April 1st of 2024. The new CFO is named Paula Oyibo and has only been with the company since 2019. This is some concern because now the future is not so certain because of the lack of management consistency; whereas Scott Settersten has been with the company for a long time and has helped grow the company at a record pace. It would be better if current management has been in their positions for longer, but they have also been brought up throughout the company, so I think they have a solid understanding of how the business operates, except for Pula Oyibo which is uncertain.

Risk and Legal Procedures

There is a very minimal risk that Ulta Beauty has to deal with other than potential tariffs because a lot of their suppliers are overseas. There are no legal proceedings as of this time.

The valuation metric used is the Free Cash Flow Yield (FCF Yield). This metric is calculated by dividing the company's free cash flow by its market capitalization. The rationale behind this approach is that if stockholders owned the entire company, they would be entitled to those free cash flows. While these cash flows will likely be reinvested in the business for purposes such as new stores, acquisitions, share repurchases, or dividends, the free cash flow ultimately represents the cash generated by the company that stockholders, as owners, have a claim to. After calculating the FCF Yield, you would compare it to the expected yield of long-term bonds. According to Terry Smith, long bond yields should be 1% higher than the rate of inflation, which typically falls around 3%-3.5%. Therefore, we would be looking for companies with an FCF Yield greater than 4.5%. This valuation method makes sense when you consider it from this perspective: stockholders want our companies to offer a "coupon rate" (represented by the FCF) that is higher than the yield of long-term bonds. Additionally, if we invest in high-quality companies, their free cash flows are likely to grow over time, unlike bond coupon rates which remain fixed. This growth provides a margin of safety and suggests that these companies will deliver strong shareholder value.

Ulta Beauty has a FCF Yield of 5.7% which makes them an attractive buying opportunity.

Investment Decision

Wondering if you should invest in a company should consider if they have a high return on capital, the ability to grow, and is at an attractive price. Looking above, it is evident that this company is worth buying.

Quae eius error ut occaecati. Qui et enim quisquam occaecati rem voluptatem. Aliquid magni laborum explicabo temporibus. Cumque officia ipsum accusantium deserunt distinctio modi. Amet ab consequatur itaque deserunt porro quo quia.

Accusantium id delectus alias et enim. Et et rem soluta eos.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...