Operating Cash Flow

The amount of cash generated by a business's operating activities.

What Is The Operating Cash Flow (OCF)?

Operating Cash Flow (OCF) is the amount of cash generated by a business's operating activities. It represents whether the company has a positive or negative cash flow from business operations. This information can be found on a statement of cash flows included in a 10-K or 10-Q statement.

Another way to look at OCF is to measure the cash generated by a company's regular business operations.

A favorable operating cash flow indicates a company can maintain and grow operations, whereas if negative, it suggests that the company might not be able to maintain its existing operations.

OCF is a critical metric to consider as it shows how much a company can pay for its current liabilities. Using the cash it generates from its operations also indicates whether a company can meet its financial obligations and service its debt.

A company that generates high levels of OCF may be better positioned to take on more debt. This suggests that it can finance capital expenditures and acquisitions without the need for equity financing.

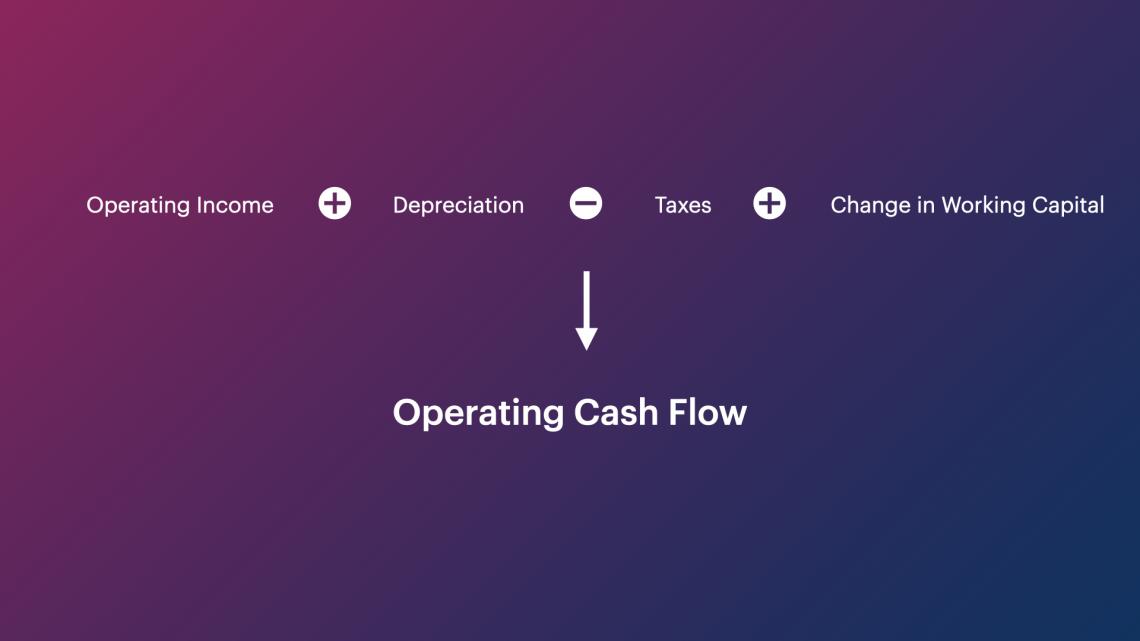

The OCF can be derived by adding a company’s non-cash expenses to its net income and adjusting for changes in working capital (current assets minus current liabilities).

However, it also suggests that businesses with low levels of operating cash flow may have difficulty meeting financial obligations. They may need equity financing to expand or cover operating expenses.

Key Takeaways

- Operating Cash Flow (OCF) is a measure of the cash generated or used by a company from its regular business operations during a specific period.

- It reflects the company's ability to generate sufficient cash to maintain and grow its operations without external financing.

- A positive OCF indicates that the company can cover its operating expenses and invest in future growth, while a negative OCF may signal financial difficulties.

- Net income is based on the accrual accounting method, which includes non-cash items. OCF, on the other hand, focuses on actual cash generated or used.

Components Of Operating Cash Flow

Many components go into the calculation. Here are the most important components:

- Net income: This is OCF's top line. It is sales minus the cost of goods sold, expenses, taxes, and interest.

- Stock-based compensation: It refers to the equity ownership awards a company gives its employees. The equity is subsequently added back to the OCF.

- Depreciation: When determining operating cash flow, the depreciation of property and equipment is also added to net income. Depreciation is simply an accounting technique designed to spread the cost of an asset over its life.

- Other operating expenses: Other operating expenses include expenses that are not directly related to production. These include rent, marketing, and office expenses, among other costs.

- They are also referred to as overhead expenses. When determining operating cash flow, other operating expenses are added to net income.

- Changes in operating assets and liabilities: Changes in operating assets and liabilities can be added or subtracted from net income when calculating OCF. Managing support and penalties include:

- Inventory: Raw materials used to produce goods and goods that are available for sale.

- Accounts Receivable: Funds owed to a company for goods or services that have already been sold.

- Accounts Payable: Funds payable to suppliers for products received but not yet paid off.

- Accrued Expenses: An expense that has been recognized but not yet paid.

- Unearned Revenue: Cash acquired by the company for a good or service that has yet to be provided.

Example Of Operating Cash Flow

For the year 2022, Company X had a net income of $250. It paid $75 to its employees through stock-based compensation. Accumulated depreciation came out to $10 for the year.

Other operating expenses amounted to $35. Inventory, accounts receivable, and accrued expenses increased by $50, $20, and $35, respectively. Finally, accounts payable decreased by $15.

To determine company X’s OCF, you can add its non-cash expenses to its net income.

The non-cash expenses were stock-based compensation, accumulated depreciation, and operating expenses. Adding these three together, you get $120. Then adding the non-cash expenses to the net income is $370.

Finally, adjustments for changes in working capital should be made. To find working capital changes, subtract inventory, accounts receivable, and accrued expenses from accounts payable. This would give a value of—$90.

Therefore, company X has an OCF of $280 ($370-$90). Above is a visualization of the calculation for 2022.

What is the cash flow statement?

The cash flow statement is a financial statement that summarizes the changes in cash that come and go from a company and is one of the three major financial statements. Broadly speaking, the cash flow statement is separated into three distinct business activities:

- Investing activities

- Financing activities

- Operating activities

Cash flow from investing activities covers the inflows & outflows of money related to investments. Items such as the purchase or sale of assets would be covered under investing activities in the cash flow statement.

Cash flow from financing activities accounts for all cash flows used to finance the company.

You can think of it as the inflow and outflow of money surrounding shareholders and lenders, which also reflect major financing decisions made by the company. It covers items such as dividends, loan payments, stock repurchases, etc.

Cash flow from operating activities is cash flow from all activities related to business operations. Cash flow from operating activities starts with net income, accounting for changes in working capital and depreciation.

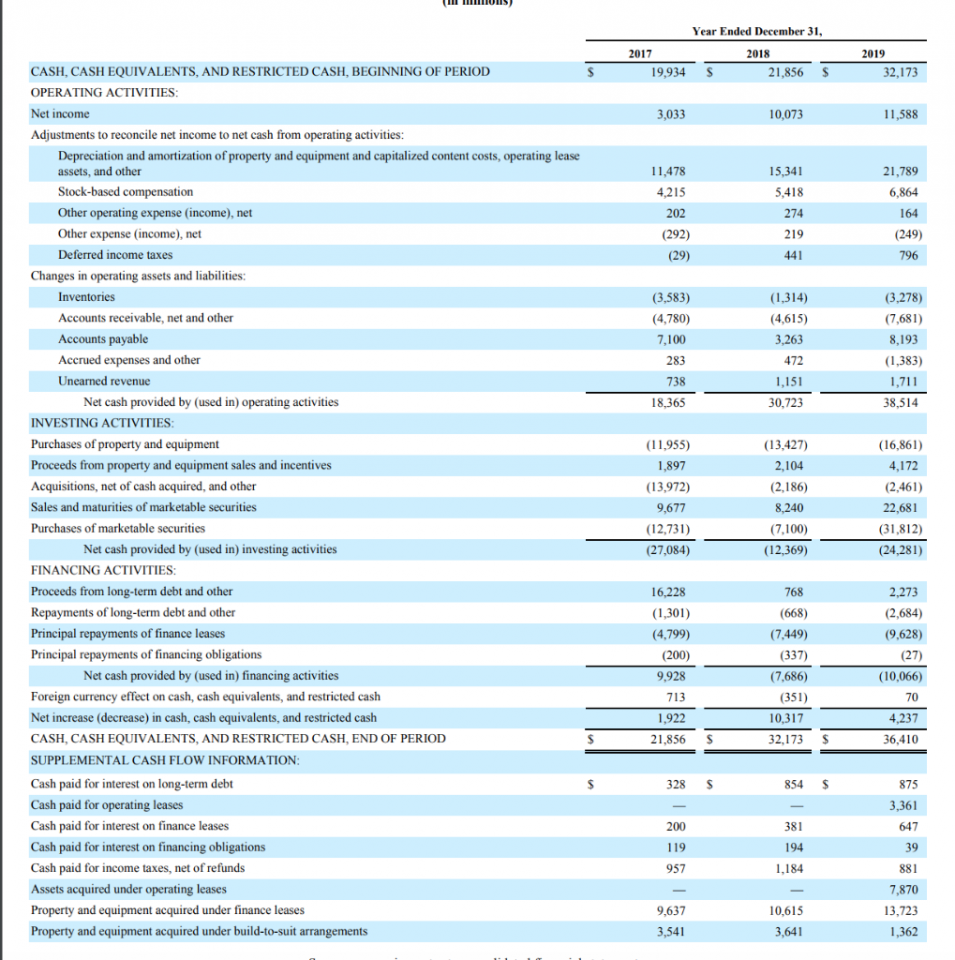

A sample cash flow statement for Amazon's (AMZN) 2020 10-K report is included below.

A cash flow statement is essential to a company's profitability and financial health. Generally, investors refer to the cash flow statement to help determine whether a company can meet its long and short-term liabilities.

Indirect vs. direct operating cash flow

There are two methods for finding OCF (indirect and direct methods). You would be tracking all cash inflows and outflows using the direct method. This method uses cash payments and receipts to find the operating cash flow.

In the direct cash flow method, cashless transactions are omitted, and only cash transactions are considered. Payments made in cash and cash received are some examples of cash transactions.

The earlier example above demonstrates the indirect method. It uses accrual-based accounting where non-cash expenses are added to net income and adjusted for working capital changes. This is the more common method used by accountants.

Although there are differences between the direct and indirect methods, they should theoretically produce the same OCF. While the direct method is more intuitive, it is also more time-consuming.

Because the direct method is time-consuming, most companies prefer utilizing the indirect method.

Operating Cash flow and company’s financial health

OCF is an essential indicator of a company's financial health.

Not only does it show the amount of cash generated by a company's regular business operations, but it also indicates whether a company can generate positive cash flow to maintain and grow its operations. Otherwise, it may need external financing for capital expansion.

A high OCF means the company has positive earnings and can repay short-term debts. A low OCF could indicate that the company cannot meet its short-term obligations, which can cause concern.

When it is low, it could be related to a lack of sales or an increase in inventory levels. This would lead to lower profits and more spending on inventory rather than other areas like marketing costs or advertising expenses.

One drawback of OCF is that it does not give a total picture of financial health. This is because it does not factor in long-term expenditures and financing activities.

While operating cash flow is useful, it must be used along with other financial metrics to get an overall picture of a company’s financial health.

Operating cash flow vs. net income vs. free cash flow

OCF is a measure of the amount of cash generated by a company's normal business operations- it highlights the ability of a company to cover its operating expenses.

Net income indicates the company's profit or loss in one fiscal year. It represents the total net income after taxes, and minority interest is deducted from revenue.

However, net income is not a good measure of financial health because it fails to account for many aspects of its balance sheet, including long-term debt, depreciation, and deferred taxes.

Free cash flow represents the cash remaining after operating expenses and capital expenditures. It shows the money remaining after a company covers all its costs and taxes.

Generally, free cash flow is used to pay dividends, perform share buybacks, finance acquisitions, and other expenditures if the company is looking to grow.

You subtract capital expenditures from operating cash flow to find free cash flow. The higher the free cash flow, the more it can pay dividends and use for company expansion.

A lower or declining free cash flow can indicate a company's struggle to generate cash. Investors use free cash flow to gauge financial health.

Both net income and free cash flow are metrics to understand profitability. Similar to operating cash flow, they can tell investors about a company's ability to pay off operating expenses. However, both net income and free cash flow account for capital expenditures.

Therefore, net income and free cash flow are considered better measures of total profitability and financial health. At the same time, OCF gives a better picture of a company's ability to cover its expenses related to direct business.

Evaluating Operating Cash Flow

Investors and lenders alike use operating cash flow to evaluate a company. It provides extensive information about a company’s profitability and liquidity.

It is also used as a benchmark for the company's ability to repay debt, pay dividends, and expand its operations. All this information is helpful to investors when deciding whether to invest in a company.

When determining a company's creditworthiness, lenders look at its OCF because it can tell them about the company’s ability to pay its necessary expenses.

A company with a high OCF is more likely to be approved for loans, while a company with a low or negative OCF will find it more difficult to borrow from lenders.

Other metrics, such as the operating cash flow ratio, can be calculated after deriving the OCF.

Without going into much detail, a ratio greater than 1.0 is desired because a company can pay off all its liabilities using the cash flow it generates from operations.

An OCF ratio of less than 1.0 signifies a company cannot pay off all its current liabilities.

Therefore, investors are often skeptical about companies with an OCF ratio below 1.0 because it may signify financial distress.

Using OCF to value a company's profitability and liquidity is helpful. However, it is important to realize that it does not give a total picture of a company's financial health.

Therefore, while OCF helps find information about a business's core operations, it must be used with other metrics.

Researched and Authored by Liam

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?