From UK B4 Audit to High Finance in Singapore?

Hi all, due to personal reasons I plan to move to Singapore within the next 3 years, and was wondering how the high finance climate is like over there and what steps I should take now to break in?

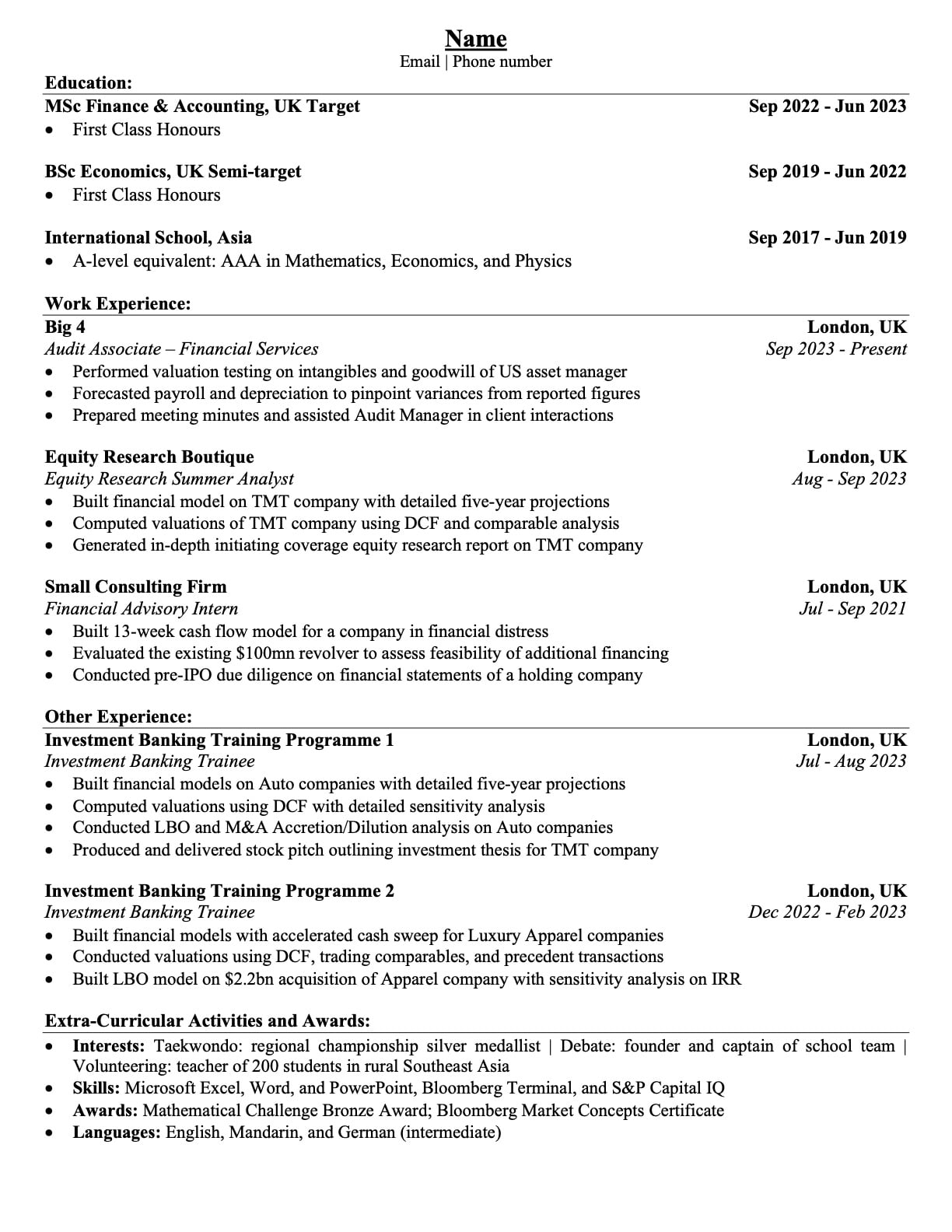

A little bit of background: scored first class for my master's at a target, completed financial modelling courses in my own time, did an equity research internship this summer (no FT as it's a small shop). Unfortunately I only took recruiting seriously during my final year of uni, which is why I applied for master's to have another shot, but we all know how difficult recruiting was for 2023 compared to Covid years :(

Right now I'm auditing asset managers, and tasks could range from repetitive invoice checking to more interesting valuation work on their investments and intangibles. I've also passed 6 of the 15 exams for ACA.

I'm pretty open to roles as long as it's front office and finance related, so investment banking (M&A, ECM, DCM, LevFin), equity research, asset management, and maybe corporate banking as well.

I feel like there is not much mention of Singapore on WSO and was wondering if the finance industry there is any different from the UK? On the plus side I feel there is some weight to the B4 name and ACA (if I do complete it), and I have relevant experience in valuation and financial modelling. The downside is that I have never worked in a bank, nor do I have any deal experience.

Would love to hear your thoughts about how I should approach this!

Tenetur consequatur reprehenderit non ratione voluptatem non. Sed facilis porro ea neque voluptas perspiciatis quidem. Est error eos aut beatae. Fugiat velit enim occaecati itaque aut ipsum.

Ut occaecati tenetur eius. Hic ut ex maxime officia. Accusantium officiis sed blanditiis dolore ut non est.

Enim sed consectetur non voluptas in praesentium. Dolor eum ipsam voluptatem optio laborum. Aut adipisci vel laborum eos voluptatem aut.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...