Top Banks in Sweden

The banking industry in Sweden has a relatively sophisticated organizational structure, and numerous banks of varying sizes and specializations are active there.

The banking industry in Sweden has a relatively sophisticated organizational structure, and numerous banks of varying sizes and specializations are active there. Sweden's banking industry is organized into four sections, which we will get to in the next section.

The largest four domestic banks in Sweden, which operate as universal banks and account for over 80% of the sector's total assets, dominate the country's banking system.

The central Bank of Sweden, or Riksbank, ensures that money has value and issues coins and banknotes.

The goal of Finansinspektionen, Sweden's financial regulatory body, was to create a single integrated regulator for the banking, securities, and insurance industries. It was founded in 1991.

Its function safeguards customers and advances the financial system's efficiency and stability. Due to robust internal controls and low-interest rates, which have contributed to sustained profitability and asset quality, Sweden's banking system is stable.

Types of Bank Accounts In Sweden

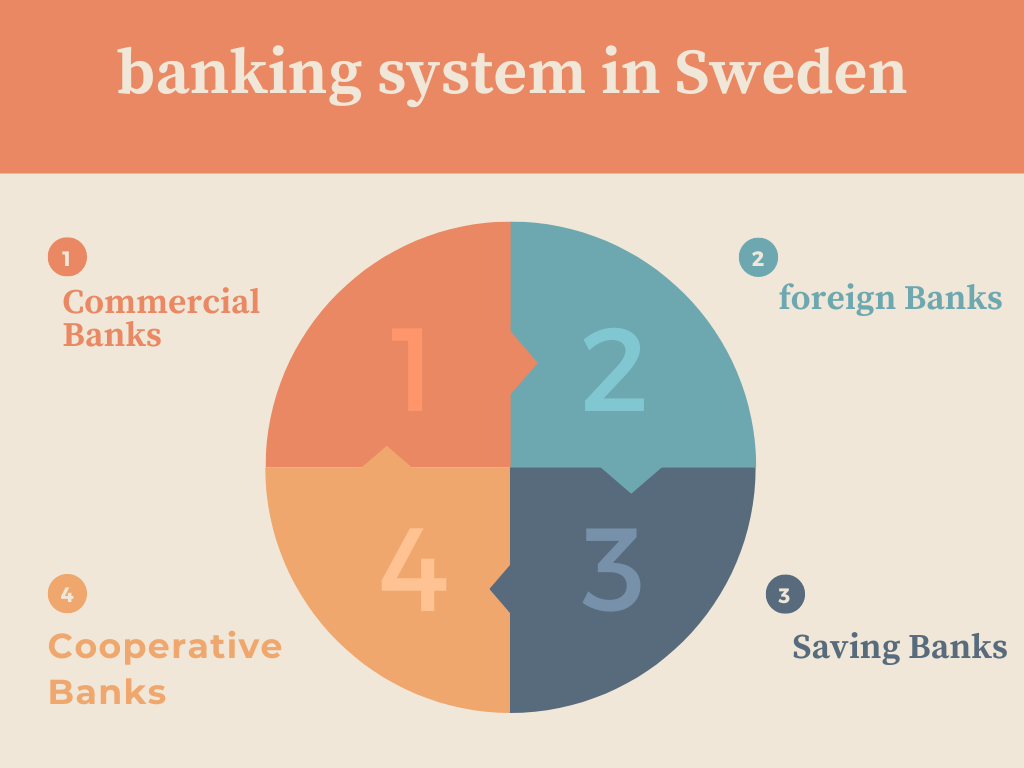

Sweden has more than 114 banks. The four largest banks in Sweden control more than 80% of the sector's total assets. The banking system is separated into four groups, which include:

Commercial banks (joint stock banks), foreign banks, Saving Banks, and Cooperative banks. The first foreign Bank was founded in 1986, and most commercial banks in the military industry were established in the middle of the 1990s.

1. Commercial banks:

The "big four" banks: Swedbank, Svenska Handelsbanken, Nordea, and S.E.B.—make up the largest of Sweden's three types of commercial banks.

These banks represent more than 75% of all public deposits and are significant players in most financial market segments.

Along with the primary four, there are other smaller, Swedish-owned commercial banks with diverse activities and ownership structures. Some of them are former savings institutions now joint-stock businesses, frequently with Swedbank as a shareholder.

The majority of other commercial banks were established between the mid-1990s and the present.

They are frequently referred to as niche banks because they primarily target the retail banking sector and offer their products and services online or through telebanking such as Avanza bank.

2. Foreigner bank:

In 1986, when foreign banks were initially permitted to form subsidiaries, the first foreign Bank was founded. The number of foreign banks decreased for a short period due to the financial crisis at the beginning of the 1990s.

Since 1990, when foreign banks were again allowed to create branches, they have grown. The total additions increased to 29 by the end of 2006. The majority of international banks focus on the securities and corporate banking markets.

The largest foreign Bank in Sweden is Danske Bank, which rose to the fifth position after acquiring OStgota Enskilda Bank in 1997 and creating regional banks.

3. Savings banks:

In Sweden, there are lots of autonomous savings institutions. They frequently operate in local or regional markets and are small. Most savings banks work together with Swedbank to provide technical solutions and a shared selection of products and services.

A cooperative bank is a business organization that provides banking services to its members. The consumer must pay a member share to join the combined Bank to enjoy its banking services. In Sweden, there are just two tiny cooperative banks.

Top banks in Sweden

Sweden is a critical player in the Nordic banking system and has significant financial ties to other major global financial hubs.

International banking has two new measures for better capturing creditor banking systems' foreign credit exposures and borrower countries'.

A Nordic banking sub-cluster has been found due to ongoing Fund research utilizing network analysis to examine financial interconnections.

Strong enough banking ties among Nordic nations have led to the inclusion of the U.S., U.K., Switzerland, France, Netherlands, and Germany, as well as the four Nordic countries in a single cluster ( Finland, Denmark, Norwich, and Sweden).

However, the Nordic nations do not belong to other clusters since their banking relationships with other countries are not as strong as Bermuda, Austria, Portugal, Brazil, Wales, etc.

Sweden's position closer to the center of the map demonstrates how important it is compared to the other Nordic nations. The giant Swedish banks have a lower cost-to-income ratio than other European banks.

The banking system in Sweden has a steady outlook, according to Moody's Investors Service, as we said because of its high asset quality, robust capital ratios, low-interest rates, and substantial deposit volume.

In the following sections, let's talk about each of the top banks in Sweden.

Nordea Bank

It is one of the biggest banks in Europe and one of the biggest financial service firms in the Nordic region. It has operations in 20 nations, including its four home markets of Norway, Denmark, Sweden, and Finland

In 2018, the group's overall operating income was E.U.R. 9 billion, and its total assets were EUR 551.4 billion. In the year 1832, the Bank began operations in Sweden.

With 4.2 million household members as of February 2018 and 200,000 business and institutional clients, Nordea Sweden bank has second or third place in the Swedish market.

3.6 million customers and households were Nordea's most prominent segment in Sweden. However, the majority of their customers were businesses in Finland. Their market penetration percentage for big companies in Finland was 100% in 2021.

Along with banking and other related financial services, Nordea Bank provides insurance, investment consulting, and security brokerage services to individuals, businesses, and significant enterprises.

Credit rating companies have given Nordea an AA+ grade, indicating its financial stability.

Nordea bank's net income in 2021 was €3.83 billion, with total assets o570.35 billion.

S.E.B. Bank

It is a top wholesale bank for big business and institutional customers. I.E.B. provides all types of financial services in Sweden, and the Bank has improved its standing among small and medium-sized enterprises.

The S.E.B. group employs around 15,000 highly qualified individuals in 20 different countries.

The group's net profit in 2018 was SEK 23.1 billion, up from SEK 16.2 billion in 2017, while its operating income in 2018 was SEK 45.9 billion, up from SEK 45.6 billion in 2017.

A bank in Sweden typically conducts business as a commercial institution and provides services such as health insurance, car insurance, checking and savings accounts, credit cards, mutual funds, foreign exchange, and financial solutions to support all your needs for residents and non-residents of the country.

S.E.B. bank's net income in 2021 was 25.42 billion S.E.K., with total assets of 3.304 trillion S.E.K.

Svenska Handelsbanken AB

The Bank first opened its doors in 1871, and it now has operations in six home counties. Currently, the Bank employs 12,000 people in more than 20 nations. The Bank received the best service among banks in 2018 for the seventh year.

It has nearly 400 locations with 4,000 advisors working for the Bank nationwide. The Bank's net income was SEK 4,015 Million, compared to 3,760,000,000 years ago in S.E.K.

Business cards, funding for investments, group and health insurance, mortgages, and private loans are just a few of the services offered by banks.

The decentralized organizational structure and solid local ties of Handelsbanken, along with its high-quality digital offerings and commitment to sustainable social responsibility, serve as the foundation for its commitment to long-term client relationships.

To support and aid their individual and business customers in their international banking transactions, they are represented in Luxembourg and the U.S.A., in addition to their home markets.

Svenska Handelsbanken ABbank'ss net income in 2021 was 19.54 billion kr, with total assets of 3.35 trillion kr.

Swedbank

Since its founding in 1820, Swedbank has grown into a global organization serving individual and business clients. Today, the Bank helps 7.3 million household customers and 600,000 business clients.

To support and aid their individual and business customers in their international banking transactions, they are represented in Luxembourg and the U.S.A., in addition to their home markets.

The Bank's mission is to support a stable and long-lasting financial condition for numerous homes and enterprises. 1One hundred eighty-six branches make up the Bank's network in Sweden, employing about 14453 people.

The decentralized organizational structure and local solidarities of Handelsbanken, along with its high-quality digital offerings and commitment to sustainable social responsibility, serve as the foundation for its commitment to long-term client relationships.

In 2018, the Bank's operational revenue was SEK 44,222 Million, w% more than in 2017. In contrast to 2017, banks' profits rose by 9% in 2018

The Bank provides investing and trading services, such as stock, foreign exchange, and fixed income trading.

Swedbank's net income in 2021 was 20.87 billion kr, with total assets of 2.75 trillion kr.

Forex Bank AB

Rolf Friberg, the owner of a travel agency, established FOREX Bank in 1965 in connection with his acquisition of the currency exchange business at Stockholm Central Station. Selling cash to tourists was a logical advancement.

The small company expanded and became FOREX. It was the only business besides banks that was permitted to exchange currencies until the early 1990s.

The Bank is one of the leading foreign exchange providers in the world. It was founded in 1965, and until 2003, its primary business was selling and purchasing money.

Following t003, the Bank began providing services like loans, accounts, cards, and payments. In addition, the Bank offers services like online, mobile, and telephone banking.

Forex Company got a bank license in 2003, changed its name to Forex Bank, and now has 107 branches across the Nordic region. The Bank's profit for the third quarter of 2018 was S.E.K. 60 million, and for the entire first nine months of 2018, it was SEK 100 million.

Forex Bank AB's net income in 2021 was 635.36 billion USD, with total assets of 1,400 million S.E.K.

Resurs Bank

It was established in Sweden in 1977 and provided retail banking financial services. Bank offers consumer loans and payment options. Aside from traditional banking services, it also offers insurance plans, retail finance, and internet shopping.

Jesus is the go-to partner for finance, payment, and loyalty solutions in the Nordic region and countless retail chains and e-commerce businesses. Using the payment method that works best for you is simple with our payment solutions.

Regardless of what you wish to undertake, they provide loans up to SEK 500,000 without collateral and at a competitive interest rate. Have more control over your monthly expenses, and they can also assist you in consolidating your debts.

At the end of 2018, the Bank's operating profit climbed by 6% to SEK 1,487 million, and its operating income increased by 11% to SEK 3,437 million. 7 The Bank employs 765 people employed by the Bank as a whole as of December 2018.

Resurs bank net income in 2021 was 3,086 million S.E.K., with total assets of 42,182 million S.E.K.

Westra Wermlands Sparbank

Westra Wermlands Sparbank was one of the earliest banks in Sweden to open its doors in 1856. This Bank is a sizable financial organization that serves millions of customers.

It provides a wide range of banking services, including savings accounts, current accounts, debit and credit cards, loans, and pension plans.

Although the Swedbank Group bought it in 1998, this Bank still trades as Westra Wermlands Sberbank. Since then, the Bank has added several hundred new employees to its staff.

Westra Wermlands Sparbank provides young students with the opportunity to train in a banking setting each year, encouraging them to understand and learn more about financial planning that will help them in their future.

Since the Bank's founding in the 19th century, it has been a pioneer in offering clients long-term support, which has sparked a lot of expansion for nearby companies.

Westra Wermlands Sparbank's total assets were 13,689.94 million S.E.K.

Avanza Bank

In 1999, the Avanza Bank was established. The headquarters of this Bank is located in Stockholm, the Swedish capital. Less than 1,000 people work for the Bank as its whole workforce.

Additionally, Avanza has a finance academy that can assist you in learning more about your interests and how to succeed in any of them, including shares, funds, tax declarations, derivatives, cryptocurrencies, and savings strategies.

Additionally, Avanza Bank has assets worth over $10 billion and an average annual income of over $100 million.

Avanza Bank is renowned for providing outstanding customer service. Due to its greatness, it has won an award each year for more than ten years running. The goal of Avanza Bank is to make banking and using financial services simple for its customers.

Avanza Group, a more significant financial organization, owns Avanza Bank. This institution owns other financial institutions in Sweden.

Avanza Bank's Revenue in 2021 was 483 Million S.E.K.

Ikano Bank

Ikano has established itself as one of Europe's leading online banks by providing excellent internet banking services. It was first established in 1988 under the name "Ikano Bank"; however, it was rebranded as Ikano Bank in 2009.

They have the same ideals as IKEA because they are owned by the same family. We think they have improved opportunities for living and working in the U.K. by providing banking on fair terms.

The Bank employed 512 people in 2019, up 34% from the previous year. Given that the Bank provides the majority of its services online, it has an adequate labor force to satisfy all its clients' demands, wherever they may be.

Ikano Bank provides several different financial services. Among the most well-liked ones are Auto loans and insurance, loans for homes, and commercial leasing.

Ikano Bank is a member of the Ikano Group.

Ikano Bank's net income in 2020 was £439,174,525.00, with total assets of £2,626,864,466.00.

Nordnet Bank

Over 400 people are employed by N.E.T. Bank, its headquarters in Sweden, and operates internationally. Additionally, this Bank has a significant presence in Finland, Denmark, and Norway.

Nordnet is a top-tier, pan-Nordic internet platform for investments and savings. Its goal has been to democratize savings and investments since its founding in 1996.

They upend conventional institutions and provide private savers with access to the same knowledge, resources, and services as experts by utilizing innovation, simplicity, and transparency.

They create the most excellent platform for saving and investing with cutting-edge financial products, innovative user journeys, and leading UX.

Initially, a broker, Nordnet Bank operates in Sweden and other countries as a full-service bank, including savings, loans, investments, and pension services. The Bank earned $147.6 million in income in 2016 and had assets worth $48.7 billion.

The digital Bank reported profits after taxes of SEK 301.9 million as of June 2020, an increase of 311% from the prior year.

Nordnet Bank's net income in 2021 was SEK 3.63 billion, with total assets of SEK 232.54 billion.

How to open a bank account when you are a refugee?

You can open a bank account and obtain a bank card if you are an asylum seeker who qualifies for the AT-UND exemption. An AT-UND document demonstrates that you don't require a work permit to work in Sweden.

The Bank must verify your identity before opening an account and accessing banking services like bank accounts and bank cards. The Bank also wants to know how you plan to use its financial services and the source of your funds.

As a result, the Bank will ask you many questions. The Bank may restrict your access to some banking services as an asylum seeker.

The Swedish Bankers' Association and the Migration Agency have developed a specific mechanism to make it easier to identify asylum seekers who are permitted to work.

To create a bank account, you must follow this procedure and present the Bank with your L.M.A. (asylum seeker) card. A certified copy of the I.D. document you gave the Migration Agency must also be shown.

A certified copy is a copy that bears a stamp attesting to its identicality to the original. The Bank will contact next the Migration Agency, who will check to see if the submitted I.D. document matches the one provided.

or Want to Sign up with your social account?