Checking Accounts vs Savings Accounts

The former account primarily focuses on daily use, which is regular transactions, whereas the latter account is designed for storing money for those who want to hold money for a long time.

Checking Account Vs. Savings Account: An Overview

Checking accounts are designed for everyday transactions, providing easy access to funds through debit cards, checks, and electronic transfers. They are ideal for regular use, such as paying bills, shopping, and transferring money.

In contrast, savings accounts are meant for long-term savings, offering limited access to funds to encourage saving. They are best for holding money for future goals or emergencies, with restrictions on the number of withdrawals allowed per month.

Most people open both accounts but don’t know the exact benefits they will receive. To open an account, the financial institution must first identify your identity by checking your social security number and government-issued identification (driver’s license or passport).

In this article, we will use Bank of America as an example to explain the similarities and differences between checking and savings accounts and will then walk through the process to demonstrate how to open an account.

Having both a checking and savings account makes transferring your money between those two accounts easier. Also, it helps you to waive the monthly maintenance fee. You can also waive those fees by linking your savings account as overdraft protection for your checking account.

The similarities between checking and savings accounts are that they all have routing and account numbers, so account holders can send and receive money.

If your checking and savings accounts are linked, you can see the balance and manage your account through your bank app or online.

Key Takeaways

- Checking accounts are for daily transactions with easy access to funds, while savings accounts are for long-term savings with limited withdrawals.

- Savings accounts typically offer higher interest rates (around 0.06% APY) compared to checking accounts (around 0.04% APY).

- Checking accounts usually have a lower minimum deposit ($35) and potential monthly maintenance fees that can be waived, while savings accounts have a higher minimum deposit ($100) and may have fees for excessive withdrawals.

- Linking checking and savings accounts allows easy transfers and can help avoid fees, such as using savings as overdraft protection for checking.

What Is a Checking Account?

A checking account primarily focuses on daily use, which is regular transactions. It is designed to give easy access to cash; people who send money through Zelle or Venmo will deposit it directly in your checking account.

The minimum deposit is $35.

There are three essential components: routing, account, and debit card. The first two numbers will be used in your check.

- Routing Number: It represents the branch bank where your account is opened. Different banks in different states have their particular routing numbers. For example, Chase Bank in Indiana has a routing number of 074000010, and in Michigan, it is 072000326.

- Account Number: It represents your cash account. Different accounts in the same bank generally have other numbers in the last four digits.

- Debit Card Number: It represents the debit card you hold. If your card is lost, damaged, or stolen, and you apply to the bank for a replacement or replacement card, the new card number you will get will be different from the old card.

This number is generally used when you purchase online. Most Debit cards are used to pay through two major payment systems: Visa or Mastercard.

It should be noted here that the account number should not be confused with the debit card number. For example, when paying to some institutions (such as schools, government departments, courts, etc.), if the payment is made according to the debit card number, the institution will charge $5-20.

If you pay by check, cash, or wire transfer online and provide the routing and account numbers, the transfer fee can be waived.

What Is a Savings Account?

A savings account is designed for those who want to save for long-term goals, such as future investments or emergencies. It is an appropriate place to keep funds that you do not need immediate access to, thereby promoting savings and financial security.

The primary purpose of a savings account is to earn interest on deposited funds, although the interest rate is typically lower than other investment options. The interest accrued is based on the annual percentage yield (APY) offered by the bank, which can vary.

While you can withdraw money from a savings account, it is not intended for regular transactions. To encourage savings, the number of withdrawals you can make is limited.

Historically, federal regulations (Regulation D) limited the number of certain types of withdrawals and transfers from savings accounts to six per month, although this regulation was temporarily relaxed during the COVID-19 pandemic.

Exceeding this limit can result in excessive withdrawal fees. However, the fees are typically not waived for in-person, ATM, or mail request withdrawals.

The minimum deposit requirement to open a savings account can vary by bank but is often around $100.

Unlike the claim that accounts will be canceled if no deposit is made within three months, banks typically do not close accounts for inactivity alone but may charge inactivity fees or impose other conditions.

Checking Account Vs. Savings Account

If you only want to open one account, here are some questions to consider when comparing those two accounts.

1. Is there a monthly maintenance fee?

Checking accounts often have monthly maintenance fees, which can sometimes be waived by meeting certain criteria (e.g., maintaining a minimum balance or having direct deposits).

Savings accounts may also have maintenance fees, which are often easier to waive with a minimum balance or regular deposits.

2. What is the minimum balance requirement?

Minimum balance requirements vary by institution and account type. Checking accounts typically have lower minimum balance requirements than savings accounts.

3. Does the account earn interest? What’s the Annual Percentage Yield (APY)?

Checking accounts usually offer little to no interest (average around 0.04% APY). Savings accounts generally offer higher interest rates (average around 0.06% APY), though this can vary significantly.

4. What are the maximum limits on ATM withdrawals for those two accounts?

Checking accounts usually have higher daily ATM withdrawal limits compared to savings accounts. Savings accounts are subject to withdrawal limits.

5. How much are the daily limits on deposits and money sent per day?

Daily deposit and transfer limits can vary by bank and account type. Checking accounts often have higher limits due to the nature of frequent transactions.

Differences Between Checking and Savings Accounts

| Feature | Checking Account | Savings Account |

|---|---|---|

| Primary Purpose | Easy access to funds for daily use | Saving money for long-term objectives |

| ATM Withdrawals | Higher daily limits | Typically lower limits |

| Interest Rates | Lower interest rates (around 0.04% APY) | Higher interest rates (around 0.06% APY) |

| Debit Card | Yes, for direct access to funds | No debit card, limited access to discourage spending |

| Check Writing | Often available | Not typically available |

| Bill Payments | Easy online bill pay and transfers | May need to transfer funds to checking first |

| Account Transfers | Easy and frequent | Can be linked to checking for easy transfers |

How to choose a Checking Account?

You would like to choose an account that does not charge you a maintenance fee or can be waived in some ways. For example, some checking accounts offer an interest rate depending on balance limits and spending requirements.

These accounts’ interest rates are generally lower than most savings account offers.

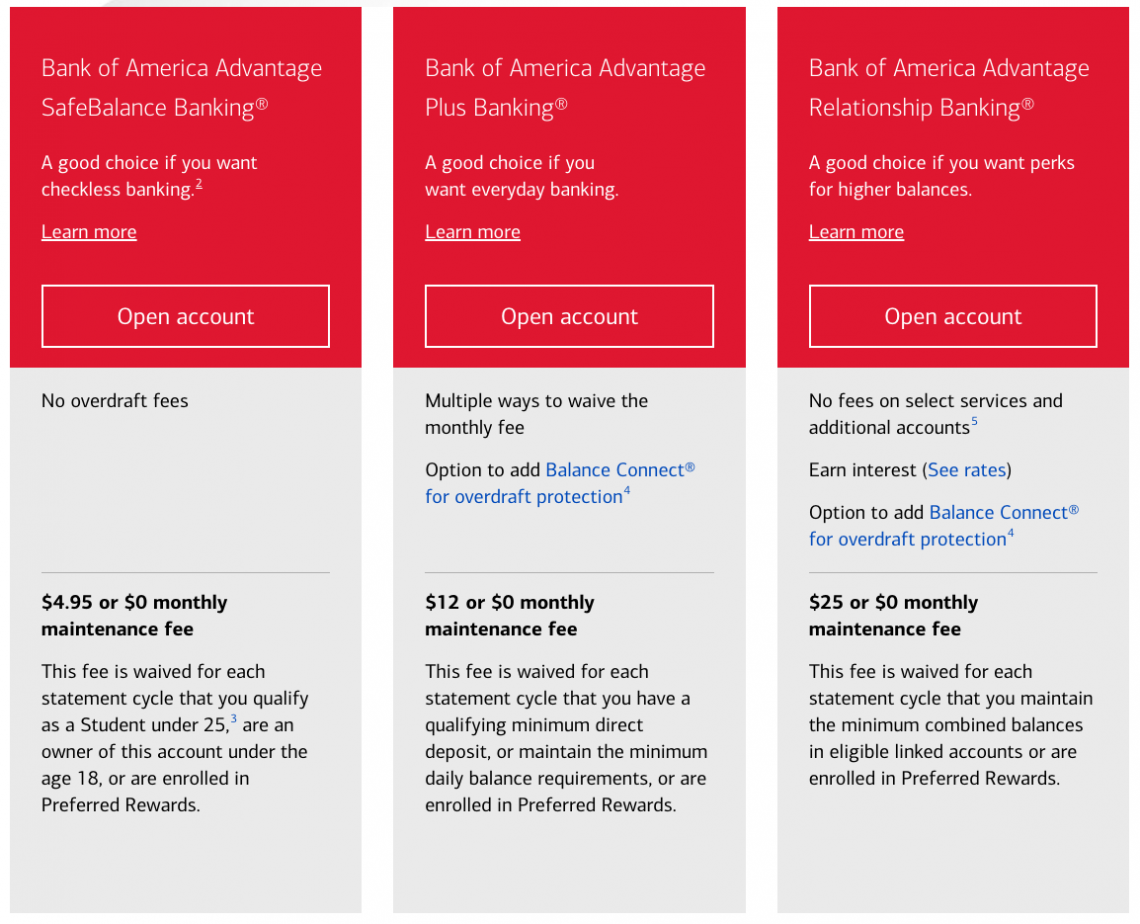

Let’s use Bank of America as an example; after you click its website, you will find that there are three options to open a new checking account. Each of them has different requirements and different monthly maintenance fees.

As you can see above, you can choose one of them that you think is beneficial. Most students choose the first one because the monthly maintenance fee can be waived if they qualify as students or are under the age of 18.

I’ll use this account as an example to show you how to open an account. First, click Open account; sometimes, BofA has a new account offer: you could get $100 by opening a new checking account.

After choosing one of those options above, click Go to Application to enter your information.

Then click Next. It will navigate you to Account Setup, where you will answer how you would like to make your first deposit and set up your PIN. Then, you will review the Terms & Conditions and finally submit your application. You’re all set.

How to choose a Savings Account?

When choosing a savings account, aim for one with a higher interest rate to help your money grow. The average interest rate can vary, with many banks offering competitive rates higher than 0.03%, particularly online and high-yield savings accounts.

Ensure the account has no monthly maintenance fees or easily waivable fees to avoid unnecessary charges. Look for features that benefit you, such as personalized financial planning, relationship rewards, easy saving options, and occasional cash-back deals.

For example, to open a savings account with Bank of America, visit their website, select the savings account option, complete the application form, specify your initial deposit, review the terms, and submit your application.

It's the same process as checking accounts. After filling out your information, click Next, and submit your application to open your savings account.

Conclusion

You can handle your money more skillfully if you are aware of the differences between checking and savings accounts, as well as their advantages.

Savings accounts, which usually provide higher interest rates, are intended to help you save money over time, while checking accounts provide easy access to your money for everyday transactions.

There are certain characteristics and specifications for every kind of account, including minimum balances, maintenance costs, and withdrawal caps.

You can optimise your savings potential and guarantee convenient access to your funds when required by assessing your financial objectives and needs.

There are even more benefits to linking your savings and checking accounts, like possible fee exemptions and simpler transactions.

Carefully selecting the best options for both types of accounts can significantly enhance your financial management and help you achieve your financial objectives.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?