BDC Venture Capital Overview

The Overall Ranking is a score from 1 star (very bad) to 5 stars (excellent) generated based on the Company Reviews of current and former employees at this company, taking everything into account.

The number you see in the middle of the donut pie chart is the simple average of these scores. If you hover over the various sections of the donut, you will see the % breakdown of each score given.

The percentile score in the title is calculated across the entire Company Database and uses an adjusted score based on Bayesian Estimates (to account for companies that have few reviews). Simply put, as a company gets more reviews, the confidence of a "true score" increases so it is pulled closer to its simple average and away from the average of the entire dataset.

- 5 Stars

- 4 Stars

- 3 Stars

- 2 Stars

- 1 Star

Company Details

BDC Venture Capital has more than $1 billion under management and almost 30 years’ experience in helping Canadian entrepreneurs realize the full potential of their ideas—for themselves and for their backers. BDC Venture Capital is the largest and most active early-stage, high-growth potential technology venture investor in Canada, working with promising entrepreneurs and private sector investors.

Typically BDC Venture Capital invests as part of a syndicate either as lead, co‑lead or follower. Initial direct venture investments usually range from $250,000 to $3,000,000 and are part of a financing round that may range from $1,000,000 to $10,000,000. Often, BDC Venture Capital will seek representation on the Board of Directors of investee companies, and sound governance practices are encouraged through the creation of a strong and well-balanced Board of Directors. BDC Venture Capital never owns more than 49% of a company’s shares.

BDC Venture Capital focuses on Canadian tech companies that are commercialising new ideas through three highly-focused funds in the IT, energy/cleantech and healthcare sectors.

Locations

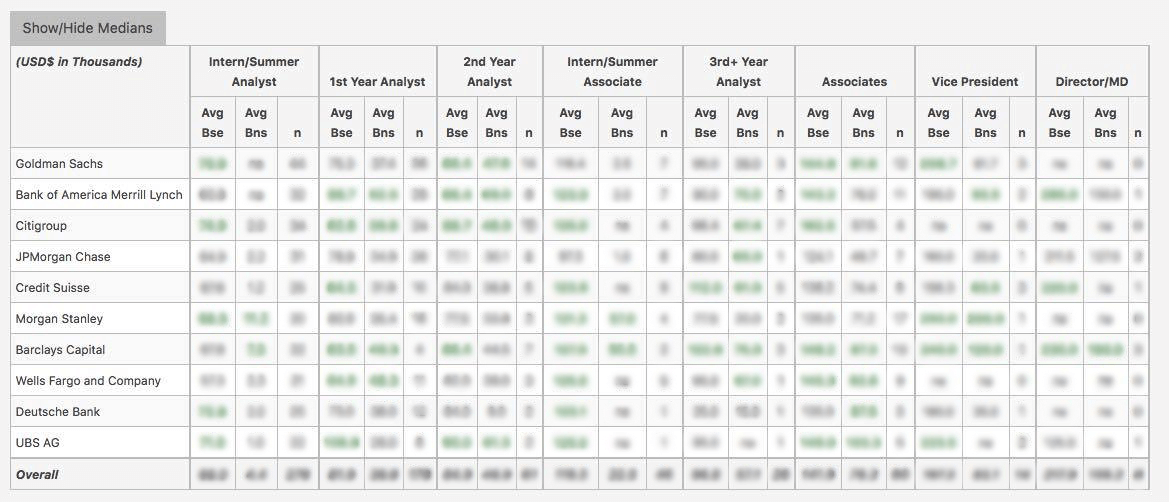

WSO Company Database Comparison Table

or Want to Sign up with your social account?