Net International Investment Position (NIIP)

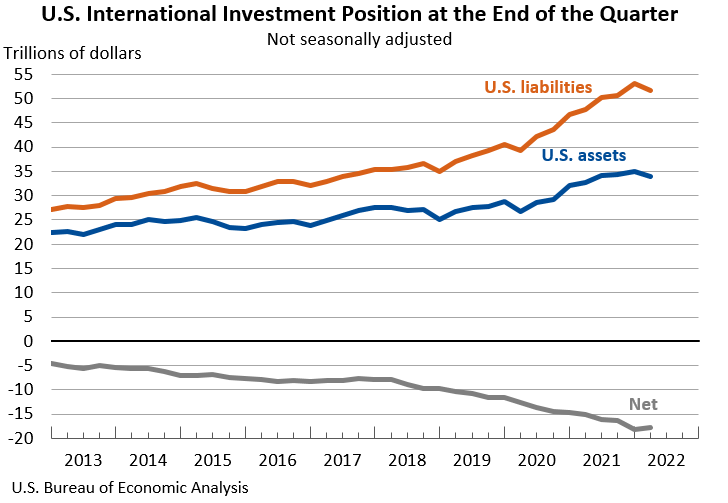

The value of foreign assets owned by a country is less than the value of domestic assets owned by foreigners.

What Is a Net International Investment Position (NIIP)?

The Net International Investment Position (NIIP) is the value of foreign assets owned by a country less the value of domestic assets owned by foreigners.

Therefore, it can be seen as a country's balance sheet with the rest of the globe at a certain period.

In other words, it is the value of foreign assets owned by a nation's commercial and public sectors less the value of foreign ownership of domestic assets. The NIIP-to-GDP ratio is a common way to quantify NIIP in relation to the size of an economy.

Government and private debt are both considered a nation's external debt. External assets owned by a nation's legal residents, both publicly and privately, are also considered when calculating this. The cyclical pattern of large valuation changes in commodities and currencies is also represented in this value.

An accounting statement of the value and make-up of a nation's external financial assets and liabilities is called the international investment position (IIP). A nation is a creditor nation if its NIIP value is positive and a debtor nation if its value is negative.

Key Takeaways

- The Net International Investment Position (NIIP) is a financial metric that represents the difference between a country's external financial assets and its external financial liabilities.

- A positive NIIP can indicate economic strength, as it means a country earns more from its foreign investments than it pays on its foreign liabilities.

- The NIIP can affect a country's currency value and creditworthiness.

- The NIIP is influenced by several factors, including trade balances, exchange rate fluctuations, changes in asset prices, and the level of foreign investment flows.

Understanding a Net International Investment Position (NIIP)

The government, the corporate sector, and the people of a country are all included in NIIP, along with their international assets and obligations.

The metric is comparable to net foreign assets (NFA), which assesses a nation's external assets and liabilities to determine if it is a creditor or debtor nation. A nation's financial standing in relation to the rest of the globe is gauged by its net international investment position.

The domestic economy is shown to be a net creditor if its value is positive; on the other hand, if the value is negative, the domestic economy is shown to be a net debtor. The net worth of an economy is determined by adding it to the value of non-financial assets.

Most countries report their data quarterly. Direct investments, portfolio investments, other investments, and reserve assets—foreign currencies, gold, and special drawing rights—are the different categories of assets counted.

Except for "reserve assets," which lack a counterpart on the liabilities side, liabilities are reported using the same classification.

NIIP is the total of historical, current account surpluses or deficits corrected for periodic valuation adjustments, i.e.

- The value of equity (stocks) is revalued upwards or downwards depending on the performance of individual stocks on the stock market;

- Valuation is also impacted by changes in exchange rates between domestic and foreign currencies.

- Non-performing debt occasionally needs to be written off.

Financial investors look at a country's creditworthiness to determine its NIIP-to-GDP ratio. As a result, the country is more susceptible to fluctuations in global financial markets, the more negative NIIP-to-GDP is.

When the COVID-19 crisis hit, several nations with sizable negative NIIPs could not access the financial markets. As a result, they were forced to accept aid from other countries to make up the budget deficits.

Factors Affecting the Net International Investment Position

Since 1990, the NIIPs of the G20 countries have diverged: from a state of near equilibrium for all countries, they have divided and, depending on the country, have demonstrated substantial liability or asset positions.

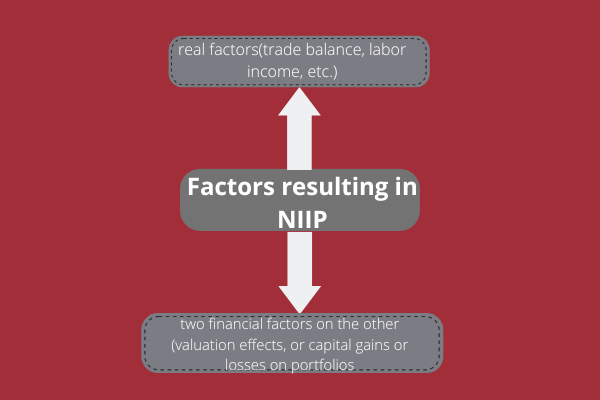

According to accounting standards, a nation's NIIP is determined by real factors on the one hand (trade balance, labor income, etc.).

On the other hand, there are also two financial factors (valuation effects, net investment income, dividends, and interest from net assets, as well as capital gains or losses on portfolios attributable to fluctuations in the price of financial assets or the exchange rate for portfolios denominated in foreign currencies.).

These financial factors are comparable to a NIIP's internal dynamics because they are wholly dependent on it, its asset structure, and the number of net assets.

Understanding these financial consequences is crucial for studying global imbalances, particularly because NIIPs have worsened over the past 30 years, considerably increasing in scale.

The divergence of the NIIP is independent of a "snowball" effect if the results of financial impacts and real factors have the same sign. However, due to the accumulation of actual causes, if it is negative (positive), it would be impacted by negative (positive) financial impacts, further polarizing the situation.

Metrics used for assessing NIIP

The ratio of the NIIP-to-Gross Domestic Product (GDP) and the ratio of NIIP to the total financial assets of the economy are two measures used to gauge the magnitude of the NIIP in relation to the size of the economy.

Financial investors use these numbers to assess a nation's creditworthiness. If the ratios are negative, the nation is vulnerable to the volatility of the world's financial markets.

When a nation builds up a sizable negative net international investment position ahead of a crisis, it may not be able to loan from the financial markets during the crisis. It may thus require financial support from other nations to pay its budget deficits.

In the past, several nations with the largest negative NIIP values gradually lowered their external liabilities and reduced their current account deficits.

When a substantial negative NIIP indicates a significant degree of debt, it might not be enough to restore full confidence. Large surpluses might be necessary to bring the negative net international investment position down to manageable levels.

As Les Nemethy examined in his Corporate Finance Column, the Net International Investment Position ("NIIP") is an extremely significant yet underutilized indication of a country's financial health.

Net International Investment Position Importance

Since NIIP plus the value of non-financial assets equals an economy's net worth, it is an important part of a country's national balance sheet. The balance of payments, transactions, and the net international investment position together reflect the international accounts of the domestic economy.

An essential indicator of a country's financial health and creditworthiness is its NIIP standing. A negative net international investment position value shows that the domestic nation is a debtor nation, with other countries owning a greater proportion of its assets than domestic owners.

In contrast, a positive net international investment position value means that the domestic nation is a creditor nation since it owns more overseas assets than foreign nations do of the domestic nation assets.

But what NIIP level is suitable for a certain nation? The metric displays the total net financial resources of all economic agents.

Because of this, the theory argues that the NIIP should adhere to the intertemporal budget constraint of the economy, but it is less clear how much it should diverge from zero for a certain nation at a specific time.

In contrast, a wealth of research on current accounts seeks to estimate standards for evaluating external positions.

Free Resources

To continue learning and advancing your career, check out these additional helpful resources:

or Want to Sign up with your social account?