Financial Modeling Code

A framework consisting of guidelines that govern the accurate and effective functioning of the financial modeling process.

Finance is the lifeblood of any business. Every business organization needs finances to carry on its business activities.

We live in a world with fierce competition in the dynamic global market. It could be because of the fear of competitiveness and lack of funding; many bright entrepreneurs from under-developed nations cannot open their startups.

Now, let's focus on those businesses that have been running for a considerable time. As an investor or a stakeholder, it is a matter of fact that we would be curious to know where the company is slated to be in the near future.

We know that the future can’t be predicted, but companies can make provisions for the future. Financial modeling is a tool by which a mathematical representation of an organization’s financial situation is derived so stakeholders can make informed decisions.

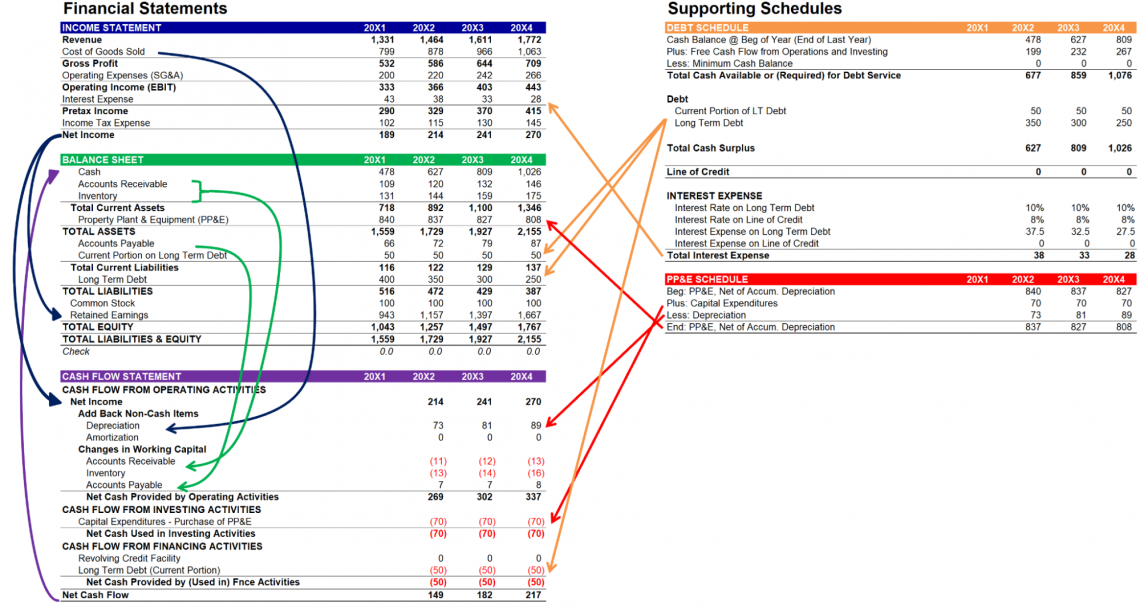

An organization’s current and potential financial situation can be assessed if all the major financial statements are properly accounted for, projected, and analyzed.

The building blocks of Financial Modelling are a company's financial statements, namely,

- Statement of Profit and Loss (Income Statement)

- Balance Sheet (Position Statement)

- Cash and Fund Flow Statements

What is the Financial Modeling Code (FMC)?

Until now, we must have understood the rationale of financial modeling - predicting the company’s financial future. Now the thing is, what exactly is the Financial Model Code?

The systematic process of recording, summarizing, analyzing, and communicating financial information is known as accounting.

The International Accounting Standards Board has laid down the IFRS (International Financial Reporting System) to bring uniformity in accounting practices globally.

Similarly, Financial Modeling Code (FMC) is a framework consisting of guidelines that govern the accurate and effective functioning of the financial modeling process.

Since this process is a crucial analytics and decision-making tool, FMC is vital in bringing uniformity. FMC guidelines also emphasize the financial data taken as a basis for financial modeling since incomplete and inaccurate data may limit the efficacy of this tool.

Here are some distinctive features of the FMCs for a better understanding:

1. Clarity, Consistency, and Transparency

The code expressly specifies that all the financial models must be easy to understand, with all the assumptions being expressly mentioned as notes to the respective financial statements. Moreover, throughout the model, it also bats for the same set of methods to be used on reliable and accurate data.

FMC emphasizes undertaking this analysis to find out how the various assumptions affect the items of the organization's financial statements. It resembles the practice of simulation, wherein it is found out what would have the company's financial position if the assumption was considered and vice versa.

3. Accountability

Financial Models should be properly documented, along with expressly mentioning the source of data, methods applied, and the assumptions made. This instills a sense of accountability and responsibility for the company in the shareholders' minds.

4. Impartiality

The developed financial models shall be reviewed, validated, and tested by an independent third-party expert whose details may be produced by the organization for the stakeholders who would make various decisions based on such data.

Objectives of Financial Model Code (FMC)

Financial Models are the future and current projections of the finances of an organization which act as the fodder for financial modeling.

FMCs are prepared with the primary objective of attaining standardization and uniformity in the financial modeling process, which will lead to an improved quality of decision-making.

For instance, the main rationale of IFRS and ISA is to attain uniformity in global financial accounting and auditing practices, respectively.

The main objectives of the Financial Model Code are listed below:

1. Improved Quality of Financial Models

Guidelines are very particular about preparing financial models based on accurate, complete, and relevant data from reliable sources. This leads to enhancing the quality of the prepared models and decisions taken.

2. Risk Mitigation

FMC lays down many acceptable practices that financial modeler companies can adopt to construct accurate and reliable models.

3. Consistency and Comparability

The Financial Model Code bats for the same set of methods applied to reliable and accurate data; throughout the financial model. This facilitates consistency and comparability, thus, leading to effective decision-making.

4. Facilitating Transparency

FMC promotes transparency by requiring financial models to be clear, easy to understand, and well-documented. This enhances the trustworthiness of the models and allows stakeholders to make informed decisions based on the model's output.

Key Aspects of Financial Model Code

By now, you must have understood that the Financial Model Code (FMC) is a framework that is followed by companies so that the financial models developed are uniform in their format and are comparable, thus aiding informed financial decisions.

The primary focus of the FMC lies in the following areas:

1. Model Development

Guidelines are laid on selecting appropriate data sources, using consistent methodologies, and incorporating sensitivity analysis while preparing the models.

2. Model Documentation

To facilitate transparency and understandability on the part of the stakeholders, FMC requires the models to be properly documented along with the source of data, the methodology used, and the various assumptions made.

3. Model Testing

The risk associated with financial modeling has to be mitigated by testing and validating the models by registered independent reviewers so that the accuracy and reliability of the model remain unaffected.

4. Model Maintenance

As for any other financial analysis tool, FMCs ensure that future projections are constantly scrutinized and reviewed in light of the ever-changing market conditions.

Types of Financial Model Code

Well, the list is long due to the vast and dynamic nature of the corporate world. Yet, let me list the most common ones.

1. Internal FMC

These guidelines provide a level of control and flexibility to the company over its financial models as the organization develops and implements the FMCs. However, their preparation and formulation can be customized to fit business needs.

2. Industry-Specific FMC

Every organization is a part of some industry. This type of FMC is prepared for the entire industry (like banking, telecom, and real estate), and all the organizations look up to it while preparing their respective models. Intra-industry comparability, standardization, consistency, and accuracy in financial models are thus the rationale of this type of FMC.

3. Regulatory FMC

Regulatory bodies design, develop, and enforce these guidelines to ensure compliance with regulatory requirements and standards.

E.g., the Securities and Exchange Commission (SEC) of the United States lays down certain rules to increase transparency and accountability in financial reporting.

These FMCs are generally strictly adhered to by all corporations under such body’s jurisdiction.

4. Open-source FMC

Under this method, guidelines are devised by a group of experts after thoughtful deliberation on the financial reporting process. After they devise the FMC, it is made available for the general public to join hands and collaborate with them. Thus, sharing the best and most suitable practices is made possible.

5. Hybrid FMC

Unlike other types of financial model codes, this type offers more flexibility and control to corporations as it combines all the elements of internal, industry-specific, and regulatory FMCs.

NOTE

Most organizations follow this since they can adopt a customized approach to financial modeling compliant with industrial standards and regulatory requirements.

6. Enterprise FMC

These are laid down and implemented by large organizations with complex financial modeling needs. They are quite similar to Internal FMC, but the only distinction is that they can deal with big business houses' humongous size and complexity.

7. Template FMC

It is quite a time-saving, cost-efficient, and easy-to-use approach, offering straight-jacket guidelines for financial reporting. Here, a pre-built framework for financial modeling can be customized and modified to fit the nature and type of business.

Spreadsheet software, such as Microsoft Excel or Google Sheets, is extensively utilized to develop financial models in a familiar and user-friendly interface.

8. Academic FMC

These are the guidelines that academic institutions and researchers follow for financial modeling education and research development.

Academic FMC offers a standardized approach to the foundation for developing practical financial modeling skills that can be used for intra-firm and inter-firm comparisons.

Application of FMC in real life

Until now, you must have understood that financial modeling is the building block of financial analysis. FMC aims to standardize these financial models, which the financial analysts of various enterprises prepare. Hence, their application is quite broad and diverse.

Banks make extensive use of financial models. Thus, FMCs for credit risk valuations in specific.

FMC guidelines help the company to perform the best practices by promoting transparency, accuracy, and standardization. As a result, financial models can reduce the extent of financial risk and support better and more informed decision-making.

Key areas where FMCs generally focus are

1. Investment Risk analysis.

This involves assessing investment opportunities, estimating returns, and analyzing risk. Moreover, FMC guidelines strive to promote best practices and guidelines that reduce the risk associated with financial modeling.

2. Business valuation

FMC guidelines provide a standardized rubric for determining a business's correct, fair, and justified value. Useful in cases of acquisitions and mergers.

3. Budgeting and Project Finance

These guidelines facilitate the forecasting of the organization’s revenues, expenses, and cash flows, which are essential for budgeting and forecasting. Moreover, they provide a standardized vision of analyzing project feasibility and estimating associated costs.

4. Financial and Strategic planning

FMC guidelines support strategic planning detrimental to any organization's survival in the long run and maintaining its competitive edge. Moreover, accurate and reliable financial statements are a basis for safe financial planning.

Pros & Cons of Financial Model Code

Financial Modelling is about making projections about the organization's future state, which is derived from a critical analysis of all its major financial statements. Projections enable the users of financial statements to have a synoptic view of the company’s future position.

Though they fail to provide the exact position the company can find itself in, if they are done using proper data and methods, the future can be predicted to a certain extent.

FMCs try to control and curb the inefficiencies associated with financial modeling.

However, like any other analytical tool, deploying this metric has pros and cons.

| PROS | CONS |

|---|---|

| Improved accuracy and reliability The consistent and continuous methodologies prescribed in the guidelines help produce accurate and reliable models. | Costly Implementing FMC guidelines lead to investments of time and finances. |

| Increased efficiency Following the guidelines leads to increased efficiency due to the development and creation of accurate and reliable models. | Lack of universal adoption Adoption of FMC guidelines is not compulsory, hence amounting to inconsistencies, discrepancies, and comparability issues in financial modeling practices. |

| Reduced risk By promoting best practices, these guidelines reduce the risk associated with financial modeling. | Restrictiveness FMC guidelines often limit the flexibility and creativity of financial modelers as they are forced to act in the prescribed manner. |

| Standardization FMC guidelines promote standardization in financial modeling, thus facilitating inter-firm comparability. | Over-Reliance These guidelines may create a sense of complacency, security, and over-reliance on the reliability and accuracy of financial statements. |

Key Takeaways

- In conclusion, the Financial Model Code (FMC) promotes accuracy, reliability, and transparency in financial modeling.

- FMC guidelines provide a framework for developing financial models, promoting best practices, and reducing the risk associated with financial modeling.

- While potential costs, restrictions, and complexities are associated with implementing FMC guidelines, the benefits of increased efficiency, standardization, and reduced risk are essential to making informed decisions in today's complex financial landscape.

- Therefore, it is essential for businesses and organizations to adopt FMC guidelines to ensure accurate and reliable financial models that provide a foundation for informed decision-making.

or Want to Sign up with your social account?