Pick Apart My IB Resume Like a Hostile Takeover - No Mercy

Hey everyone,

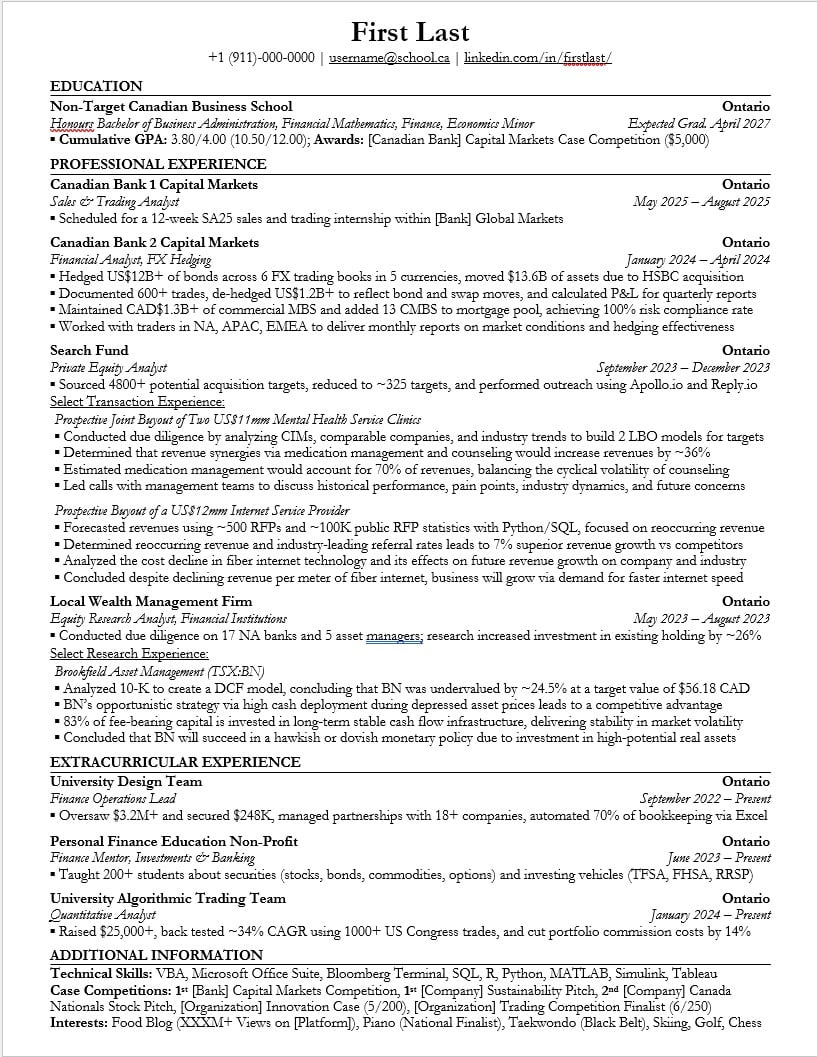

I’m heading into my second year at a non-target as a Finance/Math major in Canada. I'm aiming for an off-cycle IB role for this fall or winter term. I'm trying to make sure my resume is solid as possible before I go out and absolutely go ham on networking and crank out practice models and technicals.

Any slight visual ick, any formatting preferences, any feedback at all would be amazing. Any advice on how to go forward or what you would do in my situation would also be great and very much appreciated

Impressive experience if true…

Maybe add the word “incoming” to the top role just to be clear and it also sounds good

Yeah so long story but switched programs and got set back to first year sequence (grad 27), but credits for a math major- Hoping that having more experience will give me a better chance in recruiting- will put that in thank you!

You give away who canadian bank 2 is in the bullet points, just fyi if you’re really that worried about company anonymity

Yeah I realized that after posting lmao- I already mentioned the company in my post history so it’s fine, thanks for the heads up though

Looks like a strong resume, although take that with a grain of salt since I’m still trying to break in in Canada too… albeit with a less impressive resume.

I’d say just make sure to have a strong story of what led you to want to do IB since you did PE then trading and IB is probably more similar to the former.

got to be laurier

Voluptatem aut voluptatem fuga fuga nam aut ea. Nihil id accusantium enim cupiditate corporis est numquam. Aliquam veritatis itaque necessitatibus nihil et porro. Saepe officiis qui assumenda voluptates. Autem hic soluta error debitis aut hic doloribus. Ut vel qui laudantium corporis.

Aliquid ut iste est et amet. Assumenda ea eaque ut esse rerum omnis. Voluptatem in necessitatibus dicta praesentium quae. Consequuntur natus voluptatibus nihil repellendus quam.

Aut et asperiores ipsam veritatis cumque. Blanditiis quo nostrum nostrum numquam ut. Praesentium accusamus fugit repellat id.

Eaque at inventore non. Corrupti veniam sunt doloremque voluptatibus fugit aliquam aliquam. Doloribus omnis iusto eius veritatis. Laborum eveniet consequatur veniam beatae. Dolorum ut et nemo quisquam laboriosam libero expedita. Dolores aut corrupti voluptatem distinctio eveniet.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...