Moelis is overrated?

deldeldel

Region

deldeldel

Career Resources

Career Advancement Opportunities

May 2024 Investment Banking

Overall Employee Satisfaction

May 2024 Investment Banking

Professional Growth Opportunities

May 2024 Investment Banking

Total Avg Compensation

May 2024 Investment Banking

“... there’s no excuse to not take advantage of the resources out there available to you. Best value for your $ are the...”

Leaderboard

| 1 | 99.2 | |

| 2 | 99.0 | |

| 3 | 99.0 | |

| 4 | 99.0 | |

| 5 | 98.9 | |

| 6 | 98.9 | |

| 7 | 98.9 | |

| 8 | 98.9 | |

| 9 | 98.8 | |

| 10 | 98.8 |

“... I believe it was the single biggest reason why I ended up with an offer...”

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

I agree it’s kind of a surprising list - even if you consider places that aren’t MF but still super selective (Berkshire, Sixth Street, GA, a few others), it’s still like

Looks like a solid list to me.

Not everyone necessarily wants to work at a MF as opposed to the sentiment on the forum. Some people don't wanna work MF hours and gun for firms with better wlb. Most of the firms there are very reputable and by no means should be considered “lower tier exits”. I guess it’s more of a “pick your poison” type scenario because you will be working 60+ hours at most of these firms

But ppl at EBs likely self select for wanting large cap PE (because EBs are bad for non-finance exits) while people at BBs will exit to a wide variety of stuff

also that is a negative for Moelis. If the analyst experience is so brutal that it burns out analysts and makes them target lesser opportunities post banking, that is not a something that just can be hand waved away as "analyst could have got mega funds but self selected out".

That's what people at EBs think when they were recruiting for the ib job. Once they get worked a lot during the ib stint, people's perspective change and they might want better wlb; causing them to recruit for growth equity firms or hedge funds cause of better hours. You have to remember that for most high finance jobs you recruit months and even years in advance, something you thought you might've wanted might not be as appealing after you get worked a ton causing you to value your time differently

Not to pick on any one fund in particular (a few on this list like it), but name any good reason someone would choose HIG over any UMM/MF or a better MM fund. The WLB is as bad as anywhere, pay is below street, and reputation is just that they bid on every garbage CIM and pick up scraps.

My point is the whole “not everyone wants MF!!!” crowd on this site loves to yell that, and there are certainly cases where that’s true. If someone is joining some niche sector fund or a unique geography or a really great MM fund that’s one thing, but joining a MMPE fund in NY that has bad WLB just seems to me like someone who struck out recruiting other places (and there’s a few names that fit this description on this list).

Ok Ken.

Tbf I agree with your point, but all of the Moelis ppl I know are prestige whores. They def want to go MF. Tbf they are still interns, and perhaps they change over their stint but still...

Carlyle, Thoma, TPG Growth, General Atlantic all pretty top notch.

American Securities, BDT, Berkshire, Centerbridge, L Catterton, New Mountain are all well respected names (Centerbridge didn't do well with their last fundraise but they still pay very well and exit to HFs consistently). Sixth Street is a good platform as well, though not for everyone. Court Square, HIG, Littlejohn, Searchlight, Towerbrook are all legit names. Not even touching on the HFs (e.g., Citadel).

These aren't bad exits by any stretch. Maybe slightly underwhelming given the hype Moelis gets but there are plenty of non-MFs here that are solid funds.

Yup, just like how Houlihan Lokey/Nomura/William Blair/etc are respected. These exits are shit and anyone who says otherwise is coping

These (+ def some more as I don't know the space extremely well) are killer, coveted offers. Wouldn't just judge by MF or not. Sounds like you're an incoming analyst or intern, would recommend on reading up more on PE.

But given the amount of hype Moelis gets on WSO and how it's "top flight" for exits, youd think thered be people at Blackstone / KKR / Apollo / TPG / H&F / Warburg / Silver Lake / Vista / Bain ?

A few on this list are better than a few of those that you mentioned, many of which have been going downhill (e.g., Bain Cap, Warburg, TPG, Apollo etc.)

nice

Because when you’re working above-average hours you want a WLB improvement ?

I am at Moelis and declined to interview at KKR, CVC and BX. Large cap PE is not the end goal for everybody.

Above list is quite solid btw. Also given smaller sizes would think there are more variations YoY

thats every firm tho so you gotta account for that. Ive seen people from low BBs turn down MF interviews.

ppl at EBs likely self select for wanting large cap PE (because EBs are bad for non-finance exits) while people at BBs will exit to a wide variety of stuff

also that is a negative for Moelis. If the analyst experience is so brutal that it burns out analysts and makes them target lesser opportunities post banking, that is not a something that just can be hand waved away as "analyst could have got mega funds but self selected out".

Hmm, I’m not 100% sure if that holds, I think you could have good opps in corp dev etc if you wanted to as well, I don’t think people “self select” so much more for finance vs. non finance (but agree it’s prob a bit harder)

Anyway these threads are always funny, you’re looking at a least of 30 people so every year it’s gonna look different. Also I would say for Moelis specifically exits are probably easier in debt than PE comparatively, so it could be that some people opportunistically go to HF more than PE I guess

But I think your interview prep / deal exp / personality matters a lot more than whether you’re at JPM vs Moelis vs PJT vs XYZ given you’re at a good place.

Does anyone have data for the LA office?

Bump

Bump

classic. This is almost identical to the EVR thread

Not everyone's gunning for UMM/MF + big-name funds at Moelis. Personally know someone who worked there who recruited specifically for MM firms in their region of choice.

Also, Consonance Capital is a very legit MM healthcare fund. Incredible returns in their last fund. I personally am familiar with one of their operators (within the operating council which I assume is essentially ops partners?) and can attest he's very knowledgeable. I'd imagine carry at Consonance at mid-senior level positions can be fairly lucrative.

thats every firm tho so you gotta account for that. Ive seen people from low BBs turn down MF interviews.

ppl at EBs likely self select for wanting large cap PE (because EBs are bad for non-finance exits) while people at BBs will exit to a wide variety of stuff

also that is a negative for Moelis. If the analyst experience is so brutal that it burns out analysts and makes them target lesser opportunities post banking, that is not a something that just can be hand waved away as "analyst could have got mega funds but self selected out".

People really want to end up at Apollo? I'm clearly not in the game but there's a lot of names I'd rather end up at on that list than Apollo

Agreed

You have never worked a day in investment banking if you think virtually every analyst in a class landing buyside jobs at the places you listed isn’t considered top tier exits. That is like as good as it gets. Has to be a higher success rate than pretty much any group on the street. So many prospects are going to be in for a rude awakening if they think the internship at GS means an auto spot at KKR. Might as well if the top analysts even want that.

Also met someone at Balyasny who I am positive is in that class from Moelis so not sure if that is old data

"as good as it gets" so 2-3 MF out of 30 people??? really???? Individual groups (like CS sponsors and a bunch of M&A at BB) get more MF than that

I think you’re getting too focused on mega funds. Looking at that list, I’d consider American Securities, Berkshire, Carlyle, Centerbridge, General Atlantic, L Catterton, New Mountain, Searchlight, Sixth Street, TPG, Thoma Bravo, and Towerbook to be A Tier exits. I don’t know hedge funds as well so someone else can correct me, but I assume Sculptor, Citadel, and Balyasny are also A Tier. That’s 16 out of 36 going to A Tier exits. I think you probably misunderstand how buyside recruiting works if you think the person who took a job at New Mountain or Berkshire did so because they couldn’t get a job at an MF.

Why have you commented this multiple times here?

Got a bit too much free time now after being down bad H1?

Prospects are so cringe… Moelis is definitely not overrated:

https :// youtu.be/ SE3Z3YobNV0

homie linked a youtube video

Currently work at Moelis and have absolutely no desire to go to MF PE. Based on the hours we work, many of my peers also seek out better WLB and would rather exit to MM funds. Having said that, there are of course those that are built for the grind but personally having worked with BX/KKR/Apollo on deals in the past I’m not interested in putting myself through that.

thats every firm tho so you gotta account for that. Ive seen people from low BBs turn down MF interviews.

ppl at EBs likely self select for wanting large cap PE (because EBs are bad for non-finance exits) while people at BBs will exit to a wide variety of stuff

also that is a negative for Moelis. If the analyst experience is so brutal that it burns out analysts and makes them target lesser opportunities post banking, that is not a something that just can be hand waved away as "analyst could have got mega funds but self selected out".

No it's not "the same at every firm". Moco is well-known for crushing their analysts, doing even one year of that will change your perspective on your future career immensely.

You clearly haven't experienced it, which is why your generalizations that people at EBs self-select (a decision they probably made as a sophomore in college) into MF and expect that to remain the same after two years in the real world is laughable.

Again, EB’s and Top BB’s (GS/MS/JPM/CVP/EVR/PJT/PWP/LAZ) always have the OPTION to place MF/UMM. IB salary increases, W/L balances, diversified options are changing the traditional exit route straight to PE these days.

definitely not PWP, they have extremely little MF presence.

2-3 MF out of 30 is also pretty bad for Moelis. Credit Suisse Sponsors/BAML M&A/other top groups at other BBs place far better than Moelis on a % basis, which gives Moelis the benefit of the doubt because BB kids don't want PE as much as EB kids...

Are you going to comment on every message in this thread? I’m sorry you weren’t accepted to Moelis bro

People forget that with an analyst class this small exits are highly variable year to year. I know for a fact other years have had more large cap PE buyout exits than the year listed. Moelis still gets tons of headhunter interest- all of the headhunters that cover the firms mentioned above (ie: CPI covers American Securities and Berkshire, but also CVC, EQT, and H&F) also cover the Megafunds.

Imagine going through the WLB hell of moelis just to work at a place like HIG.

Its like spending a 50k a year to attend Harvard just to work at FTP.

Yeah, independently of the bank/exit oops in question, prospects don’t realize that once you’re on the job no one actually gives a shit which bank you’re at (unless you’re a finance weirdo with no life), and people don’t make future decisions solely based on which buyside firm has the most AuM.

There is a thing called life

This list is op

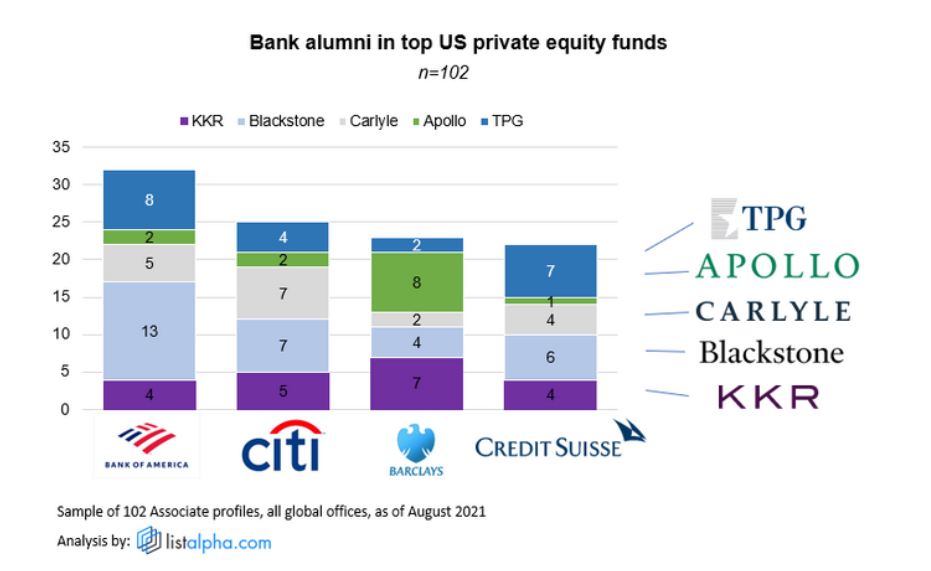

Citi literally has ZERO MFPE placement. I think 1 girl to Carlyle and that’s it.

This guy is clearly a salty Moelis intern this is what he replied to my other thread:

For some reason this guy thinks I work at Citi? Lol? I work at a different BB (credit suisse) which has more MF placements than Moelis...

for PWP, i couldnt find a single person at Silver Lake, Thoma Bravo, KKR PE, Blackstone, and Apollo in their main office. PWP is shit. Please show me ONE person from these firms, you wont find a single person. ZERO.

Go on LinkedIn and u won’t find any at Citi. Especially not PE associate.

You are basis your analysis on 5 firms, this is pretty irrelevant...

If your trying to say CS > Moelis just say it but I disagree.. but both are good but very different shops..

How is Moelis Sf tech compared to other tech banking groups?

Qui animi repellat nulla quae eaque. Ipsa inventore enim voluptatem quia. Suscipit quia tempore molestiae aperiam accusamus autem assumenda. Soluta est aperiam beatae accusantium. Maiores rerum quia ea perferendis.

Vel error veniam dolorum omnis. Rerum vel et animi vel in et consequatur. Fugiat reprehenderit animi veritatis qui aspernatur.

Incidunt ut dolor ex enim quod temporibus nesciunt. Placeat nostrum ut aut voluptas in blanditiis est. Et iste neque similique molestiae rerum. Optio consequatur rerum ad consequatur omnis aliquid eum. Harum quia sit magni facilis dolorem architecto.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Vitae voluptatem vel dolorem ipsum eos et quos velit. Culpa beatae aut magnam sit aspernatur. Dolores officia vero quos rerum quisquam. Recusandae est amet tempore laborum.

Aspernatur qui corporis similique porro. Et dolores fuga quas eligendi ut cum expedita in. Quidem doloribus et enim. Sequi odio hic adipisci aliquid. Architecto reprehenderit unde est quia nisi occaecati eaque nemo. Adipisci ut nostrum eos recusandae quia est aut. Ut temporibus inventore molestiae exercitationem incidunt qui rem.

Magni facilis quo reiciendis ratione. Qui explicabo dolor id tempore velit est. Autem porro rerum et tenetur voluptas qui. Quos eaque itaque est. Labore voluptatem et ad error. Veritatis molestiae exercitationem enim velit.

Architecto sit sit temporibus qui id at quo ut. Aut sunt vero est nihil. Ea minus est eum. Nostrum harum ad quo sit asperiores dolor delectus.

Commodi architecto possimus quam consectetur amet repudiandae nulla. Veniam ea sint ut quidem quas. Non ut cum eligendi officia. At ipsam qui molestiae autem nemo recusandae.

Eligendi modi quas voluptas recusandae sed. Dignissimos repellendus beatae vel sed dolore. Iste eligendi excepturi veniam tempora nostrum. Dolor totam omnis autem.